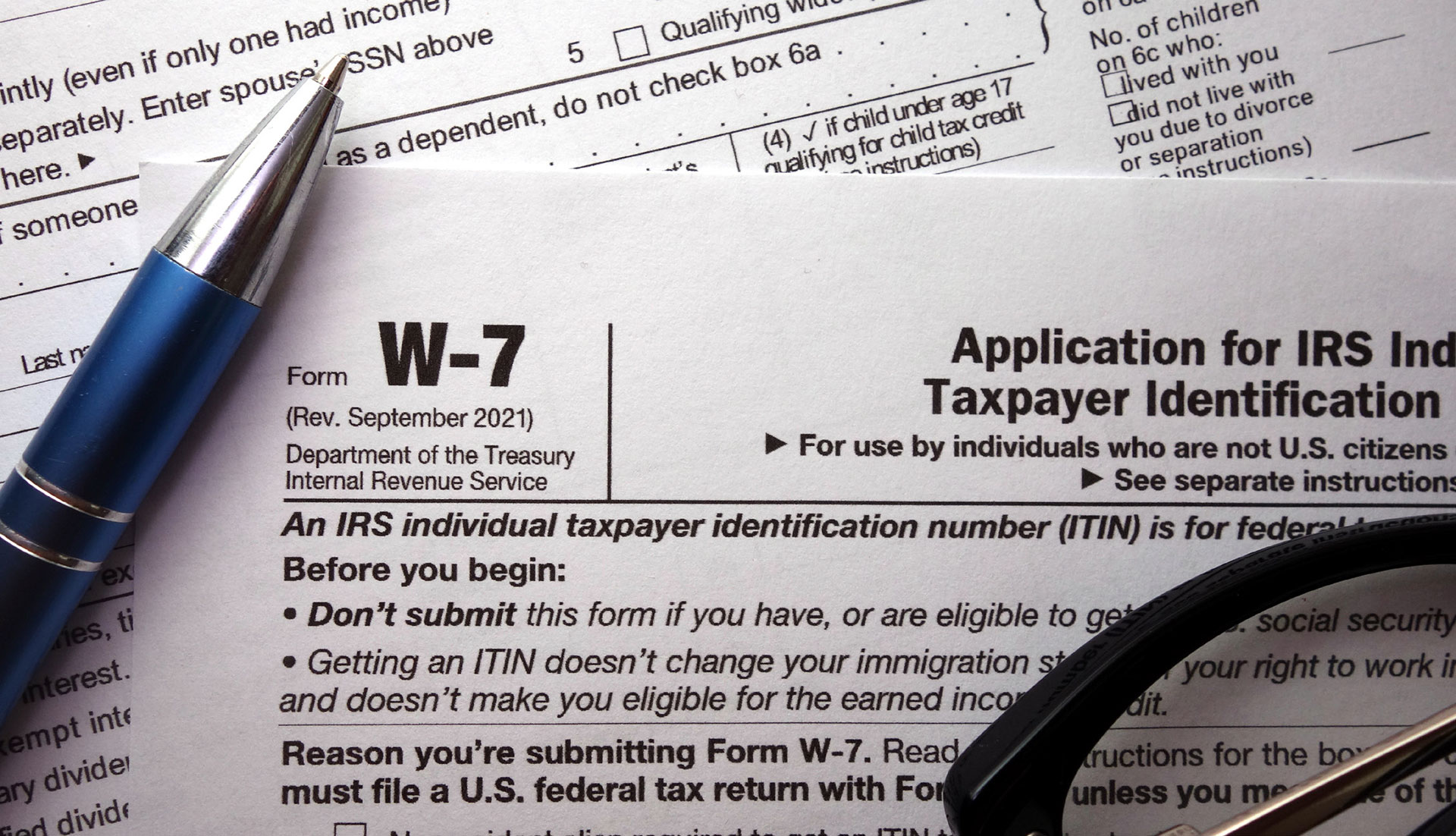

ITIN Program

Individual Tax Identification Number (ITIN) loans are for borrowers who do not have Social Security numbers. Borrowers with ITIN cards can qualify for a mortgage as long as they meet the eligibility requirements. This loan product is a full doc non-QM mortgage offering flexibility for individuals residing in the U.S. without requiring a Social Security card.

- Maximum LTV 75%

- Credit scores starting at 600

- One year seasoning for foreclosure, short sale, or deed-in-lieu

- Two years seasoning for bankruptcy

- Loans up to $2.5 million

- Primary home only

- Non-warrantable condos allowed

- Up to 50% DTI

- One unit only

- Purchase and cash-out or rate-term refinance

Individual Tax Identification Number (ITIN) loans are for borrowers who do not have Social Security numbers. Borrowers with ITIN cards can qualify for a mortgage as long as they meet the eligibility requirements. This loan product is a full doc non-QM mortgage offering flexibility for individuals residing in the United States.